Colombo, August 09 2022 – Sri Lanka Telecom Group (SLT Group), the National ICT Solutions Provider, posted stable growth for the first half of 2022, with revenues increasing by 6% to Rs 52.9 Bn and a 19.8% increase in profit before tax (PBT) at Rs. 7.2 Bn against the same period last year, showcasing resilience in its business model amidst complex socioeconomic challenges facing the country.

Demonstrating operational efficiency, SLT Group’s EBITDA (Earnings Before Interest, Tax, Depreciation and Amortisation) went up to Rs. 20.9 Bn for the first half of 2022, recording a growth of 7.8% compared to the corresponding period of the previous year. The EBITDA Margin stood at 39.7% for the period under review.

Building on the success of the previous quarter, the SLT Group was able to maintain a positive momentum for Q2 2022 recording gains of 4% in operating profit when compared to the previous quarter. The Group recorded a foreign exchange gain of Rs. 135 Mn during the quarter due to the prudent foreign exchange strategies of the Group. However, profit after tax (PAT) declined by 26.5% in Q2 compared to the previous quarter, mainly owing to the increase in income tax expenses during the period.

The SLT Group continued its strategic plan implemented at the beginning of the year, consolidating its performance throughout Q2 as well. However, during the period from April to June, the Group faced several business growth challenges including an unprecedented economic crisis, import restrictions, inflationary pressures etc. Furthermore, ongoing investments were affected; new projects were also impacted due to the increase of operational costs and the energy and fuel crisis resulted in operational challenges. Overcoming uncertainties, the Group with resilience made headway in strategic investments, undertaking appropriate management controls, in addition to managing the revenue portfolio in multiple segments.

The Operating Cash Flows of the Group grew to Rs. 23.5 Bn, up by 21.2% year-on-year. The Group recorded a favourable cash and cash equivalents position of Rs. 27 Bn as at the end of the reporting period. SLT Group’s contribution to the Government of Sri Lanka during the first half of 2022 amounted to Rs. 14 Bn. in direct and indirect taxes including levies and dividends.

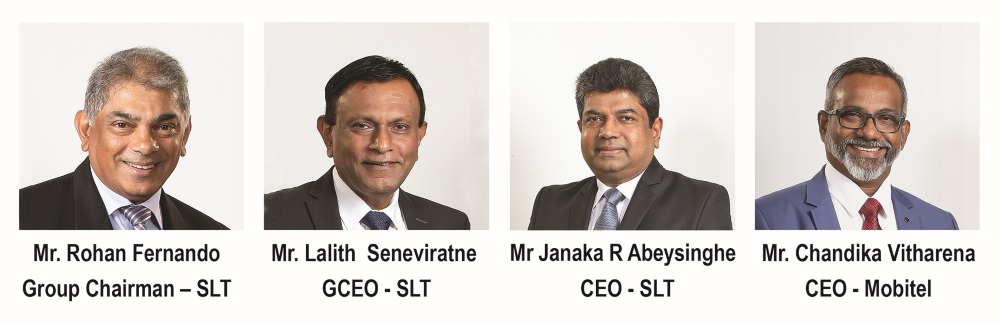

SLT Group Chairman, Rohan Fernando said, “The period under review has been one of the most challenging periods that SLT-MOBITEL has faced in recent times exacerbated by a tough operating environment. However, due to the agility in our business model to deliver growth and a motivated team effort, we have been able to successfully generate positive results.

We are determined to continue the incredible transformation we have been experiencing in 2021 across our markets and believe our major drivers of growth remain our technologically advanced portfolio and efforts in the digital space, will fuel future growth and drive our revenues in the coming quarters.”

SLT Group Chief Executive Officer, Lalith Seneviratne added, “This quarter’s results reflect the strong execution in our strategic plans, taking bold measures to shape and sustain our business and the market. Despite the various macroeconomic factors that are reshaping the business environment, we look at the future confidently with a positive outlook. We aim to accelerate investments in the next half of 2022 expanding our local and global footprint, networks, and systems, channelling our efforts towards enabling a digital transformation journey for the nation.”

The holding company of the Group, Sri Lanka Telecom PLC (SLT) recorded an impressive 12.4% revenue growth for the first of half 2022, compared to the same period of the previous year. The EBITDA of the Company grew to Rs. 11.8 Bn, up by 10.2% year-on-year.

SLT Chief Executive Officer, Janaka Abeysinghe commented, “Our Q2 results reflect our ability to mitigate the financial impact of challenging operating conditions. Our continued efficiency drives have ensured that we have been able to increase our margins and overall maintain a steady performance. As market headwinds begin to ease, we aim to enter the remainder of the year with confidence targeting growth despite inflationary pressures, continuing our strategic focus leveraging capabilities to deliver greater returns.”

The mobile services arm of the Group, Mobitel recorded a flat revenue of Rs 23 Bn for the first half of the year, compared to the same period last year. EBITDA growth witnessed a marginal increase of 1% for the first half at Rs 9.5 Bn, while EBIT saw a decline of 3% at Rs 4.9 Bn.

Despite challenging macroeconomic conditions, Mobitel Q2 results are encouraging; recording Rs. 0.7Bn profit for the quarter, demonstrating fortitude in being able to maintain its performance levels for the first half of the year. Looking ahead, Mobitel aims to increase its growth in international business revenues, enhance productivity and efficiency in all areas including power and energy.

Mobitel Chief Executive Officer, Chandika Vitharena stated, “During the period under review we have continued to deliver a steady performance, demonstrating agility, as we address the growing and ever-changing customer needs and market dynamics across our operations. We remain focused on achieving key strategic priorities that would enable a smarter digital tomorrow while striving to deliver a great customer experience with innovative products and plans.”