The Planter’ Association of Ceylon (PA) renewed calls for urgent action from policymakers to greenlight diversification into more lucrative crops like oil palm, in the wake of a sharp reduction in prices of tea and rubber over the first half of 2023 (1H23).

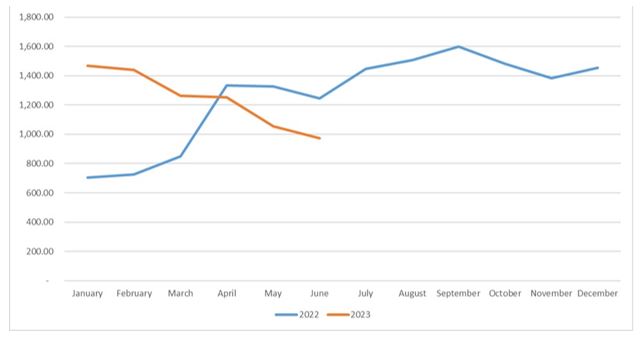

Following on record prices in 2022, when tea moved from Rs. 704.7 per kilogram up to Rs. 1,245.2 per kg in June, and up to an all-time high of Rs. 1,599.5 per kg by September, prices have been on a steady decline in 2023.

Starting from Rs. 1,466 per kg in January 2022, average prices have since reduced to just Rs. 974.4 per kg by June 2023. This amounts to a 24.4% Year-on-Year (YoY) reduction, and a drastic 40.3% reduction between Jan-June 2023.

National Tea Price Averages

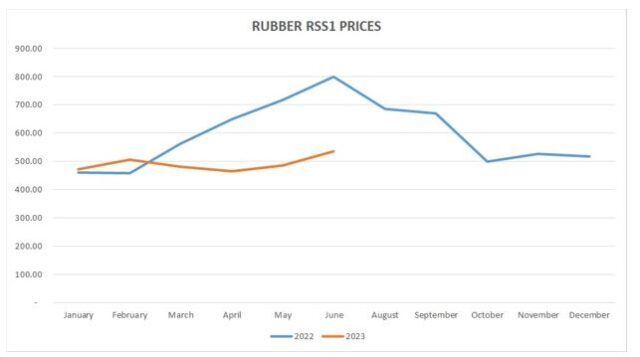

Rubber prices too experienced significant volatility throughout 2022, moving from Rs. 461 per kg of Grade 1 Ribbed Smoked Sheets (RSS1) up to an annual high of Rs. 800 in June 2023, before collapsing back to Rs. 472.7 per kg in January 2023. While rubber prices have appreciated marginally to Rs. 536.3 per kg in June 2023, average prices of rubber for 1H23 were 21.4% less than the corresponding period of 2022.

“Sri Lanka’s plantation industry is in urgent need of a realignment. The price dynamics over the past 6 months show strong signs of a continuing downturn across both tea and rubber. Tea prices have been impacted by increasing production in competitor nations, while rubber prices affected by continuing supply-demand mismatches in the wake of the COVID pandemic. Demand for finished rubber products while showing marginal improvemnts, has been relatively stagnant compared to the past 3 years. Sri Lanka’s low productivity is also eroding our ability to compete with larger regional producers,

“While we maintain that there must always be a place for Sri Lankan tea and rubber, we have to acknowledge that securing the future of our nation’s plantation industry requires extensive crop diversification. We can no longer limit ourselves to just two main crops. Already significant investments are being channeled across the RPC sector into an array of crops – from a wide range of fruit cultivation to coffee and even several varieties of berries. However, we note with disappointment that there has still been little to no progress on expanding of sustainable oil palm cultivation,” PA Chairman Senaka Alawattegama noted.

Oil palm is well understood to be significantly more profitable than tea and rubber. Based on 2020 data, on average, oil palm generates a profit per hectare of Rs. 605,000 as compared with Rs. 269,600 for coconut. By contrast, both tea and rubber are currently generating losses. This in turn means that oil palm can generate significantly larger volumes of foreign currency earnings utilizing significantly less land and other agricultural inputs.

At present, local consumption is around 264,000 MT, from which only about 20-25% is produced locally. Expanding in coconut from the present 40,000 MT to meet the shortfall is neither economically viable nor technically feasible. Presently, Sri Lankan oil palm cultivation covers approximately 12,000 Ha, less than 1% of the total agricultural land in the country. In 2021, the country paid an average of Rs. 475 per kg for imported crude palm oil. The same imported crude palm oil in India costs Rs. 300 per kg. The massive taxes (55% of the total CPO price) imposed on imported palm oil in Sri Lanka to balance it with coconut oil prices will only make sense if backed up by a comprehensive plan for expanding local oil palm cultivation.

Currently, Sri Lanka’s local consumption of edible oils stands at approximately 264,000 MT, with only about 20-25% being produced domestically. Expanding coconut production from the current 40,000 MT to bridge the gap is neither economically viable nor technically feasible.

Conversely, Sri Lanka’s oil palm cultivation covers about 12,000 Ha, which is less than 1% of the total agricultural land. In 2021, the country paid an average of Rs. 475 per kg for imported crude palm oil, while the same product costs Rs. 300 per kg in India. The significant taxes (55% of the total CPO price) imposed on imported palm oil in Sri Lanka to match coconut oil prices would only be justified with a comprehensive plan to expand local oil palm cultivation.

“There is an extremely narrow window in which RPCs are able to re-establish oil palm nurseries, and planting of mature seedlings. Once monsoon conditions set in, we will be locked out of any further progress on oil palm cultivation until next year. Given that the Government has already acknowledged the need for replanting existing oil palm and expanding our current capacity, it is essential that the relevant policy makers take urgent action to empower RPCs to move ahead. Especially given our expectation of unfavorable price dynamics over the remainder of the year, and the ongoing downturn in Sri Lanka’s export revenue, as a nation, we cannot afford to delay any further,” Alawattegama said.