LankaPropertyWeb’s recent studies revealed that while most countries experienced sharp reductions in real estate prices due to the pandemic, in Sri Lanka property prices have remained steady.

According to the House Price Index developed by LankaPropertyWeb, all 4 of its key metrics including Apartment prices, House prices and Land prices in Colombo and Sri Lanka were stable between the first two quarters of 2020. Prices for Apartments had peaked during early 2018 but dropped in 2019, and haven’t shown a significant shift in the last 3 quarters.

These results are a stark contrast when compared to countries like the UK, Australia and Singapore. According to the reports of mortgage lender Nationwide, the UK witnessed a property price reduction of.4% in June and 1.7% in May. This was the country’s highest property price fluctuation since 2009. In Australia, CoreLogic’s daily index revealed Melbourne had recorded a 3% reduction in real estate prices in the second quarter. While Singapore experienced its highest property price reduction in 3 years during the same period.

Overall Real Estate Prices in Sri Lanka for Q1 & Q2 2020

| Average Price (Rs.) | Q1 2020 | Q2 2020 |

| Sri Lanka Overall House Sale price | 37.42 million | 37.33 million |

| Sri Lanka Overall Apartment Sale price | 41.26 million | 41.35 million |

| Sri Lanka Overall Residential Land price | 1.67 million Per perch | 1.72 million Per perch |

Source: LankaPropertyWeb.com

LankaPropertyWeb’s studies also show that interest in property among buyers is growing. Traffic to lankapropertyweb.com increased by 124% and leads rose by 228% between the start of the lockdown and June. The site recorded the highest website visits in its 13-year history during the month of June as well. A surge in traffic of 19% was recorded further from USA, Italy, UK, France and the Middle East.

Catering to the new normal LankaPropertyWeb also launched Sri Lanka’s first ever Virtual Property Expo. The 3-day event held in July had over 6000 prospective buyers visiting from around the world.

Commenting on the current market, Managing Director of LankaPropertyWeb, Daham Gunaratna said the high level of interest amongst buyers earlier in the year keeps increasing even now. “We have also noticed a rise in expats looking to buy properties in Sri Lanka as their second home. Investors are looking out for good bargains during this time too. Developers and agents are closing sales and there has been an increase in that since June.

With developers and sellers currently offering discounts of up to 15%, it is unlikely that any further discounts will be offered. This is because it may have a significant impact on their bottom-line. For buyers, this is the best time to invest in property before real estate prices start to pick up or savvy investors snap these deals.”

He further welcomed the reduction of housing loan rates by some banks to below 10% and added that it would have a positive effect on the affordable and mid-range property market.

Land Price Changes between Q1 2019 and Q1 2020

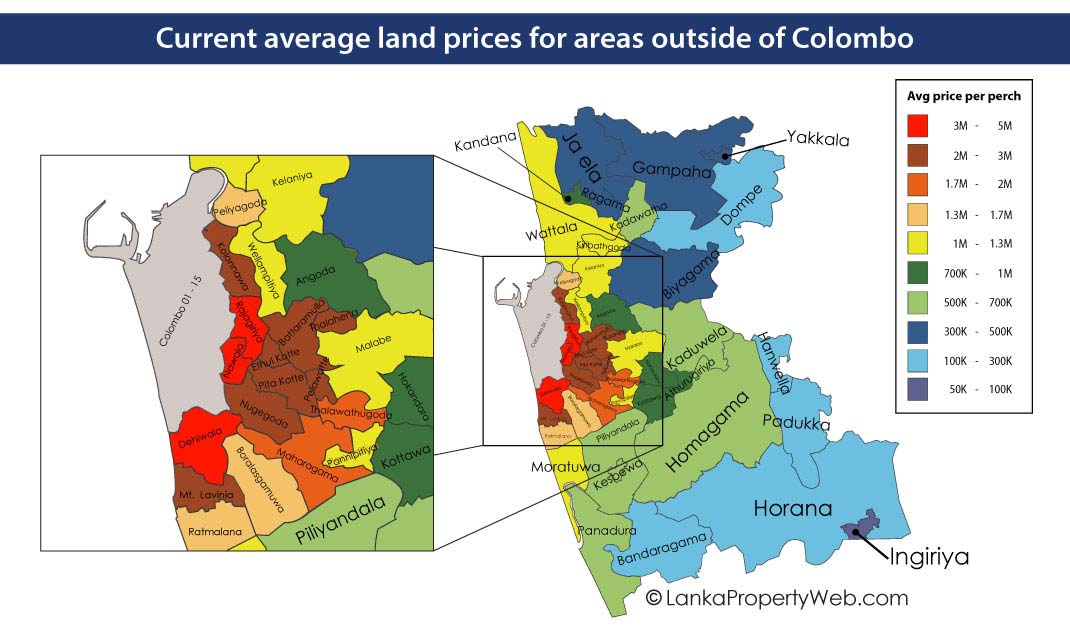

In a separate study done by LankaPropertyWeb, a comparison between land prices in the first quarters of 2019 and 2020 showed an increase in the Western Province prior to the spread of COVID-19 in March.

During the first quarter of 2020, the overall price per perch in the Western Province had risen by 21%. While in Colombo there was a reduction of up to 2%. Colombo 3, 4 & 6 also showed price declines during the same period. However, the outer suburbs that are the areas beyond Colombo 1-15 recorded hikes up to 25%. The reason for this contrasting price nature is generally a result of the affordable real estate prices in the outer suburbs.

LankaPropertyWeb’s search records also showed that during the lockdown and post-lockdown there have been a rising number of google searches for properties. These were especially in search of property in Kandy, Dehiwala, Nugegoda and Negombo. With repatriation taking place at the same time, the demand for properties in the suburbs is expected to rise further in the future.

In the Kalutara district, the price per perch rose by 38% of its previous record in the 1st quarter of 2020. But, Gampaha district—the second populated city after Colombo—had only recorded an increase of 17% per perch.

Nawala and Pita Kotte saw a reduction in property prices by 1% in the first quarter of 2020. However, Rajagiriya and Nugegoda showed price hikes of 47% and 13% respectively. Hanwalla, Athurugirya, Battaramulla and Kiribathgoda also saw similar price hikes ranging from 40% – 80%.

These records show that while Colombo is well in demand for property, it is the suburbs that people are looking to live in. The affordable home prices, social distancing capabilities, and a housing market that is appealing in every way have further influenced this behaviour.

Western Province land price variations in comparison to the other districts in Sri Lanka during the 1st quarter of 2020

In the North-Western Province, the capital city Kurunegala recorded a price hike of 238% in Q1 2020. This is a huge increase from the previous 7% that was recorded during the Q1 2019. In the Southern Province, Galle and Weligama have also shown price hikes of 141% and 115% more than its previous prices. With developments taking place and new expressway lines coming up, people’s interest in these areas is expected to grow even more. This could result in further price spikes over time while also creating a unique demand for land in Sri Lanka.

On the whole, in Sri Lanka, the average increase in price per perch was 28% during the first quarter of this year. This value may increase further in future with the country overcoming its downfalls during COVID-19 and working on development.

The pandemic has certainly brought many negatives to countries across the world, but Sri Lanka’s proactive strategies have managed to prevent its worst effects. This has also contributed to the country’s ability to maintain a stable property market despite the virus outbreak. And so, while other nations are working on saving its downfalling property market, for Sri Lankans this has become the best time to invest in real estate.