Financial freedom is not a fairytale and, with the right amount of planning, you too can secure your financial future for your family. So, on Children’s Day 2017, celebrated in Sri Lanka on October 1, don’t just spend money on toys or treats, instead take a serious decision to invest in your children’s dreams, and enable them to take a significant step forward in achieving a financially independent future for themselves.

“Putting your money into a children’s savings account, which holds it for years with only minimal interest earned, is just another way to stop you from achieving financial independence for your kids, for instance when they require it to pursue their dream career”, noted Dilan Jayakody, a concerned parent, and Retail Sales Manager at expert financial planner NDB Wealth.

Further, NDB Wealth recommends those who are truly worried about their kids look into investing in higher impact investment plans, such as Kid’s Saver and Kid’s Saver Plus, both from NDB Wealth, which allow access to real, and smart, savings.

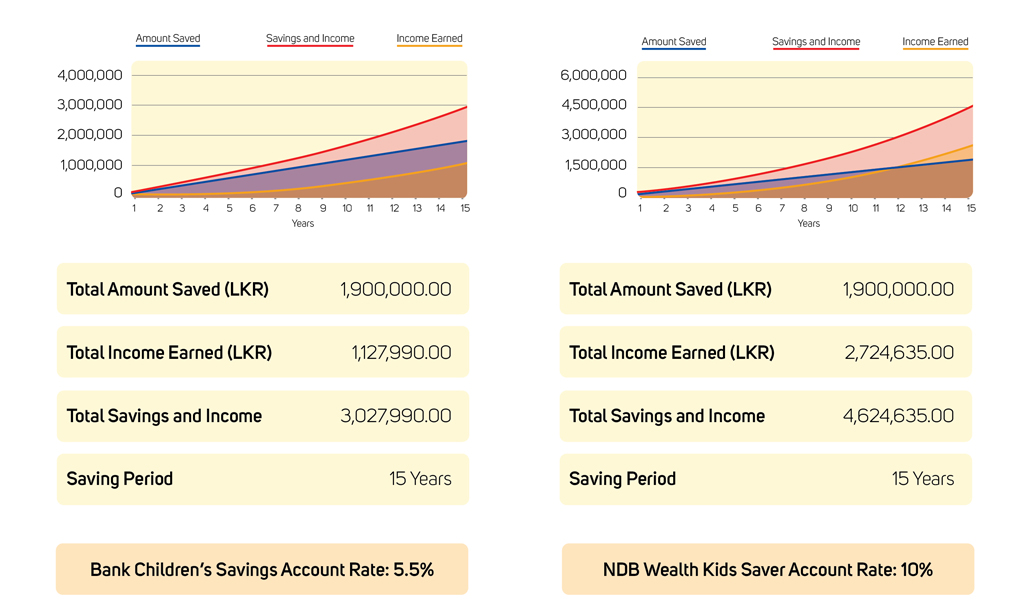

In particular, the compounding of interest, or earning interest on interest, is one very important factor that parents must consider when it comes to smarter savings, and especially long-term savings as is often the case with children. Consider an initial investment of Rs. 100,000, with an additional Rs. 10,000 contributed per month for 15 years. With most banks children’s savings, you earn a rate of return of around 5.5%. But, with the NDB Wealth Kid’s Saver plan, the rate of return increases to around 10%. So, undoubtedly, the additional earnings at the end of 15 years will likely be quite significant.

Beyond earning higher interest rates only, NDB Wealth Kid’s Saver and Kid’s Saver Plus plans also allow for withdrawals at any time, as well as ‘ploughing back’ every rupee earned into your children’s account.

To get started, you can visit the NDB Wealth website to check out available plans for children, women, families and retirement income. You can even access the website’s “Auto Wealth Planner” function to custom design a plan that meets your individualised financial need. Alternatively, you can call or visit NDB Wealth to contact a Relationship Manager, enabling an even more personalised level of service. For additional information, visit www.ndbwealth.com.