Ad trade is on course to reach a value of $1trn by 2025, with three companies – Meta, Alphabet and Amazon – accounting for more than half of the market

WARC Global Advertising Trends: Where is the money going?

2 December 2021 – New advertising spend forecasts for 100 markets worldwide show that the global ad market has largely weathered the impact of COVID-19, so far, and is on course to reach a value of US$1trn in 2025, with more than half of this money paid to just three companies: Alphabet, Meta and Amazon. This is according to WARC, the international marketing intelligence service, which publishes the findings as part of its new WARC Data Premium suite.

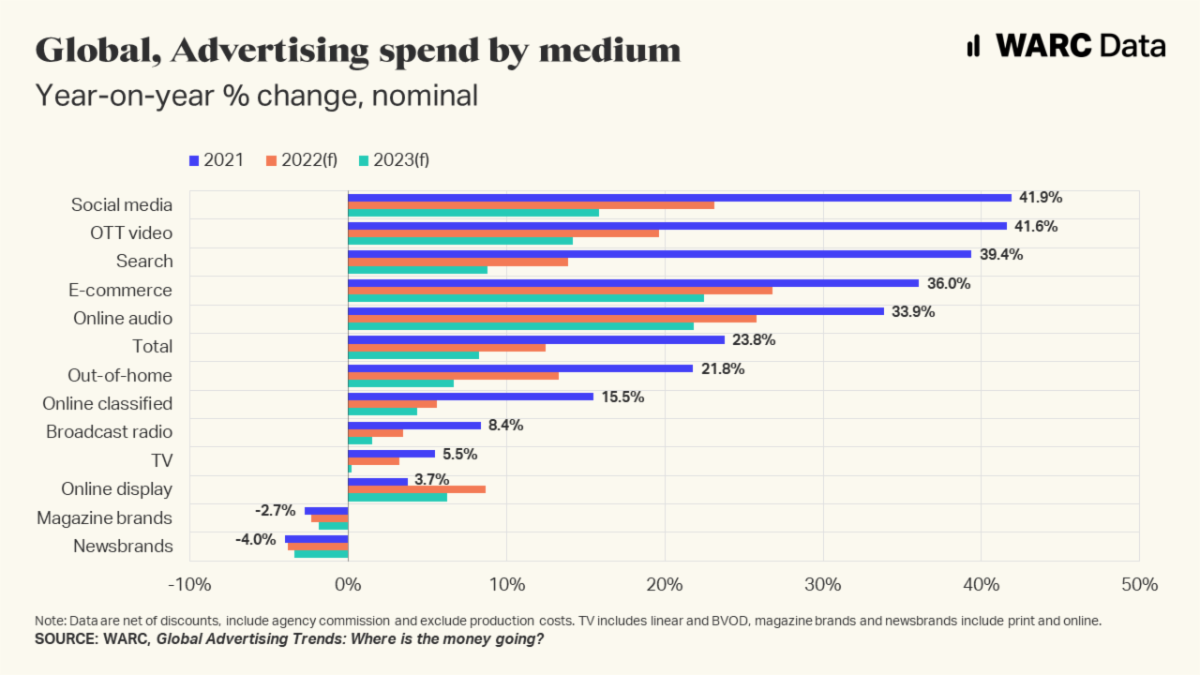

Following on from a meteoric 23.8% rise to a total of US$771bn this year – the strongest growth in WARC’s four decades of market monitoring – advertising investment is forecast to rise by a further 12.5% and 8.3% in 2022 and 2023 respectively, with e-commerce platforms set to lead this growth.

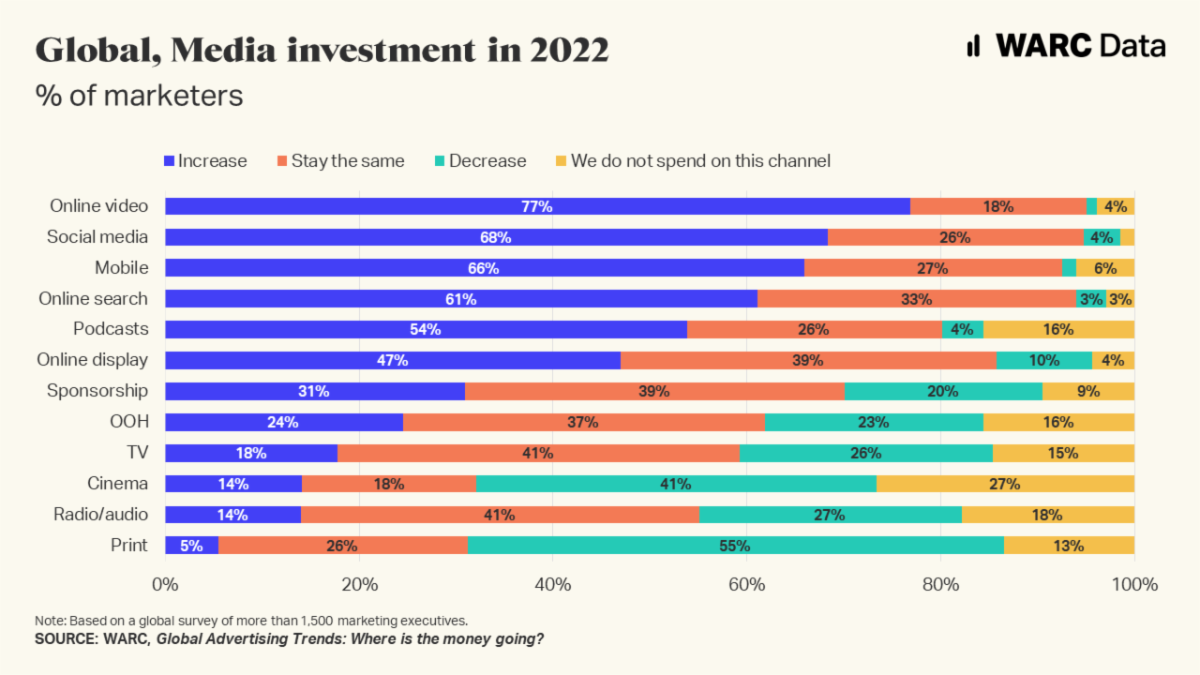

The findings are accompanied by a proprietary survey recently carried out for WARC’s Marketer’s Toolkit 2022, of 1,500+ marketing practitioners, which shows that two in three already committing budgets to Amazon are intending to increase that spend. A full 66% of advertising professionals are planning to up spend on TikTok next year, while YouTube (61% of surveyed practitioners), Instagram (60%) and Google (57%) are also set to benefit from higher spend in 2022.

Currently though, WARC finds that all product sectors are projected to top pre-COVID investment next year, while most sectors were able to record a full recovery this year. Notable exceptions include transport & tourism, which led growth with an absolute increase of $12.5bn this year but is still almost $2.9bn down on pre-pandemic spending levels.

James McDonald, Director of Data, Intelligence & Forecasting, WARC says: “Despite potential headwinds, market data show that we are currently witnessing a boom in advertising trade like none seen before, led by increased demand for retail media and ancillary publishers such as Google and Instagram, which is now the world’s largest social platform. Our projections show that this trend is set to continue, with Alphabet, Meta and Amazon now on track to account for more than half of an advertising market worth $1trn in 2025.

“New coronavirus variants – such as Omicron – may have a negative impact on our current outlook, and while our base scenario assumes that impact is muted, we will continue to review that position each quarter.”

Trends by online media and format

- E-commerce: The sector is expected to lead growth to 2023, by when the market’s value will have more than doubled from 2020’s level to a total of $137.2bn. Growth in China’s advertising market is cooling but in the west it is booming, with Amazon on course to amass over $57bn in advertising revenue by 2023 (up 72% from this year and 308% from 2019, prior to the pandemic). Two in three practitioners already committing budgets to Amazon are intending to increase that spend, while heightened advertiser demand is pushing up the average cost-per-click.

- Social media: This was the fastest-growing online sector in 2021, with spend rising 41.9% – or $55.7bn – to a total of $188.8bn this year. Instagram grew to become the largest social media platform in 2021 after overtaking the core Facebook platform for the first time. Instagram is forecast to grow to control over a third of the global social media market in 2023. TikTok saw ad revenue rise 151.5% this year and is expected to record growth of 75.4% in 2022. Two in three marketers surveyed by WARC say they intend to up spend on TikTok next year, the highest rate across all online platforms.

- OTT video: Premium online video platforms – aka over-the-top (OTT) – such as YouTube and Amazon Prime Video, were worth a combined $63.7bn to advertisers in 2021, up 41.6% from a year earlier. Further growth, of 19.7% and 14.2%, is projected during 2022 and 2023 respectively, with YouTube leading the charge and set to be worth $41.4bn by the end of the forecast period.

- Paid search: Alphabet is the world’s largest media owner and Google the largest individual platform: its advertising revenue rose by 40.6% to $146.3bn this year, taking 79.7% of all search spend and 19.0% of all advertising spend worldwide. Google’s growth is set to ease to 14.8% in 2022, though 57% of practitioners surveyed by WARC are planning to increase spend on the platform next year.

- Online audio: Advertising spend on online audio rose by a third to $5.4bn in 2021, with podcast spend up 50.9% and streaming up 28.4%. Both formats are expected to see gains to 2023, by when the online audio sector as a whole is expected to be worth $8.3bn. Spotify is one of the main players, it is set to see ad income top $2bn for the first time in 2023.

Trends by legacy media and format

- TV: Advertiser spend – inclusive on linear TV and broadcaster catch up services – is projected to grow by 3.3% to $184.7bn in 2022 following a 5.5% rise this year. Linear TV is set to remain larger than OTT – services such as YouTube and Amazon Prime Video – for the duration of the forecast period, though its share of global adspend will dip below a fifth as broadcaster’s video-on-demand (BVOD) services attract incremental dollars.

- Out of home: The market recorded a recovery of 21.8% this year, though that was not enough to offset the 28.2% decline recorded in 2020 as the coronavirus outbreak first brought the world to a standstill. The sector’s fortunes are heavily dependent on the possibility of future social restrictions in response to emerging variants, though currently growth of 13.3% is expected in 2022.

- Cinema: Spend was heavily curtailed in 2020 as cinema chains had to shutter in response to the outbreak, resulting in a 71.2% fall in advertiser investment. Spend rebounded strongly this year, buoyed by a new James Bond film, to record a rise of 149.9%. Further growth, of 26.1%, is currently projected for 2022 but, as with the OOH sector, this is provisional.

- Broadcast radio: Investment in broadcast radio ads rose by 8.4% – or $2.5bn – this year and is set to grow by 3.5% in 2022 and a further 1.5% in 2023, by when the market will be worth $34.3bn. Consequently, it is the only legacy medium set to record continuous growth over the forecast period.

- Newsbrands: Advertising spend on print and online news dipped by 4.0% this year, with an 8.9% rise for online platforms negated by a 7.4% decline among print titles. These trends are set to continue to 2023, resulting in online platforms accounting for 42% of total newsbrand ad revenue, up from a share of 31% today.

- Magazine brands: As with the news sector, investment gains for online titles were not enough to stymie print losses. Consequently, the total market was down 6.6% in 2021, with a 6.1% dip forecast next year and a 5.2% fall expected in 2023. The online component of the total will grow continuously, however, to command a 49.6% share of ad revenue in 2023.

Trends by product category (Five largest in 2022)

- Telecoms & utilities: Helped by its double-digit growth in 2020, telecoms & utilities is the first category to record advertising spend above the $100bn mark in a single year (2021). Strong investment in online advertising will help fuel further rises, leaving the vertical’s total level of spend in 2023 more than double the pre-pandemic figure in 2019.

- Business & industrial: Spend grew by a quarter in 2021 and a further increase of 13.4% to a total of $94.1bn is expected in 2022. Growth from business advertisers in 2023 will be the second-quickest rate across all categories, behind telecoms & utilities, and this brings total spend above $100bn. The sector includes a substantial amount of classified advertising within real estate and recruitment – two bellwethers of wider economic health.

- Media & publishing: Advertising investment was largely flat in 2020 but surged in 2021, rising by 33.4% to take total spend to $83.6bn. Double-digit increases in the next two years will push investment above the $100bn mark by 2023.

- Retail: A cut of $5.4bn in 2020 will more than be recovered this year – investment will rise by 20.0% before easing to 10.1% growth in 2022. A further increase in 2023 will lift total spend to $89.5bn, by which point online media will account for more than three-fifths of all investment.

- Financial services: Mild growth in 2020 coupled with steep cuts to automotive advertising has pushed financial services into the top five largest categories. Total spend rose by almost one-third this year and this will take total spend to $63.9bn. Double-digit growth is expected in 2022 and 2023, by when investment will be two-thirds higher than in 2019.

A sample of the full report is available to view here.

Global Ad Trends, a bi-monthly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments, is part of WARC Data Premium, a dedicated independent and objective one-stop online subscription service which rigorously harmonises, aggregates, verifies and evaluates data from over 100 reputable sources, including Nielsen, GWI, iab, Kantar, Ipsos and WFA.