Facebook loses $237BN in largest one-day drop in stock market HISTORY: Zuckerberg warns staff he might CRY over ‘scratched eye’ as shares fall 26% – dragging Nasdaq down 3.7% – and he drops out of Forbes ten richest after users decline

-

- Facebook’s plunging stock price weighed on world markets on Thursday, dragging down major stock indexes

- In a company-wide meeting that same day, he appeared red-eyed and said he might cry due to a scratched eye

- He cited an ‘unprecedented level of competition’ from TikTok and told employees to focus on video

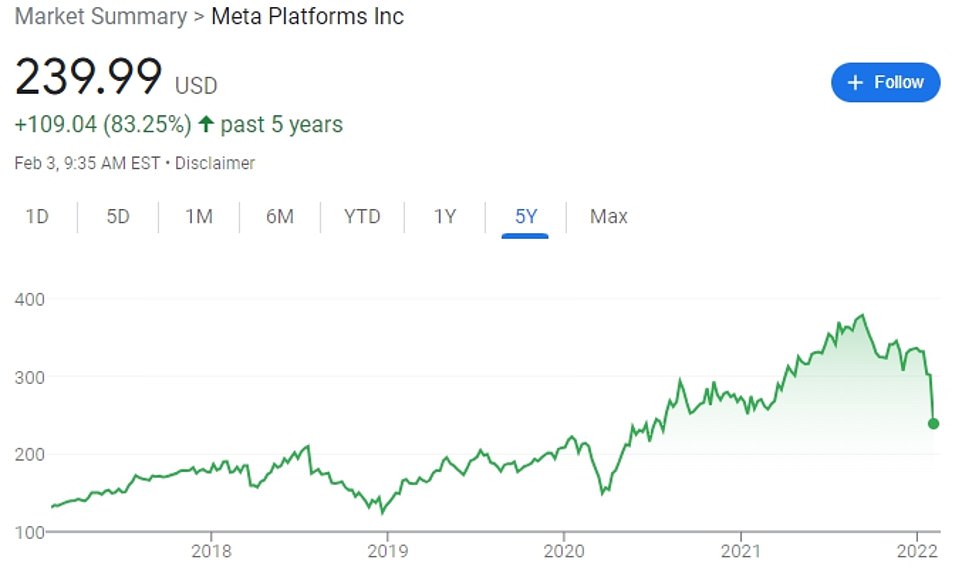

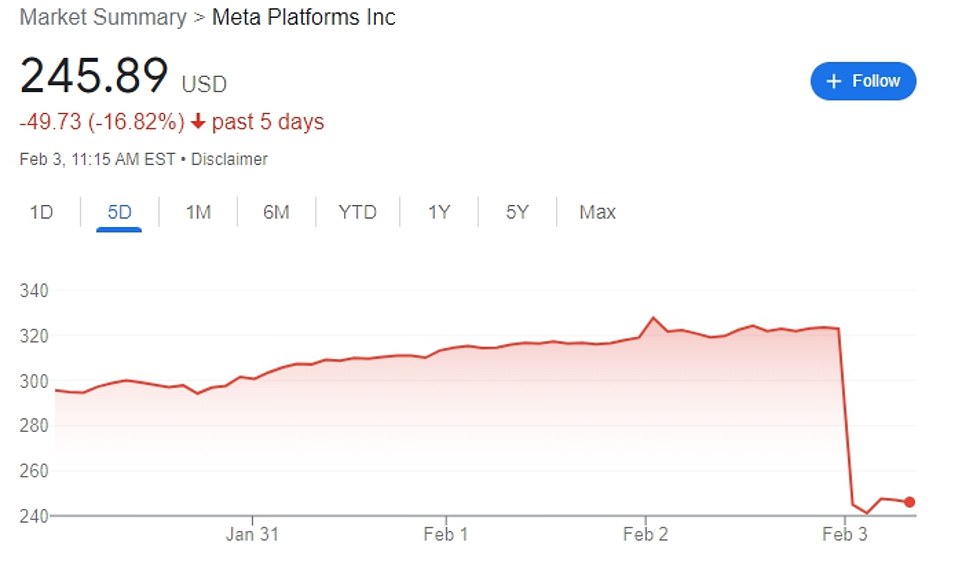

- Shares in Facebook owner Meta fell 24% in morning trading after the company’s dismal earnings report

- The decline marked Facebook’s worst one-day loss since its Wall Street debut in 2012

- The company’s overall value dropped by $200 billion, a figure greater than the entire Greek economy

- Facebook CEO Mark Zuckerberg saw $29 billion erased from his net worth

Facebook CEO Mark Zuckerberg told his employees to focus on video products and warned that he might cry from a scratched eye during a virtual company-wide meeting Thursday after the social media giant lost $237 billion – the biggest single-day loss ever recorded.

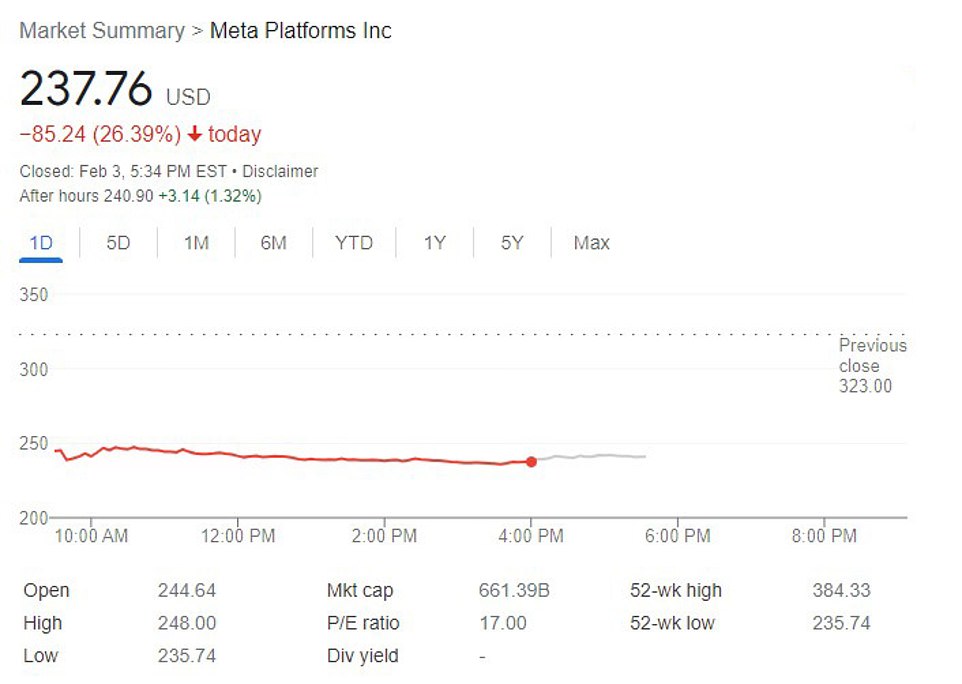

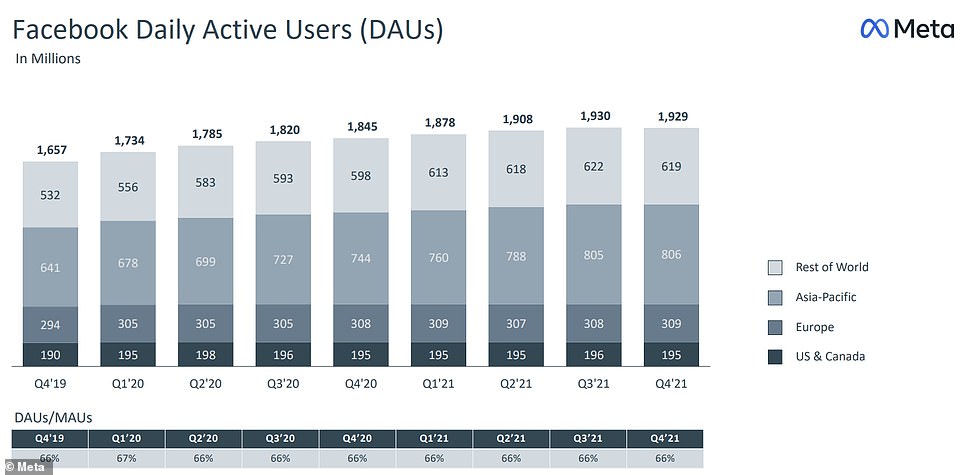

Shares in Facebook owner Meta fell 26 percent Thursday when the markets closed, after the social media giant issued a dismal forecast and reported its first decline in daily active users. Zuckerberg saw at least $29.7 billion erased from his net worth.

The tech titan was the world’s seventh wealthiest person on Wednesday, with a net worth of $113.1billion. But by market close on Thursday, he dropped off Forbes’ top 10 list of billionaires – to No. 12 – as his personal net worth plunged to $83.4 billion.

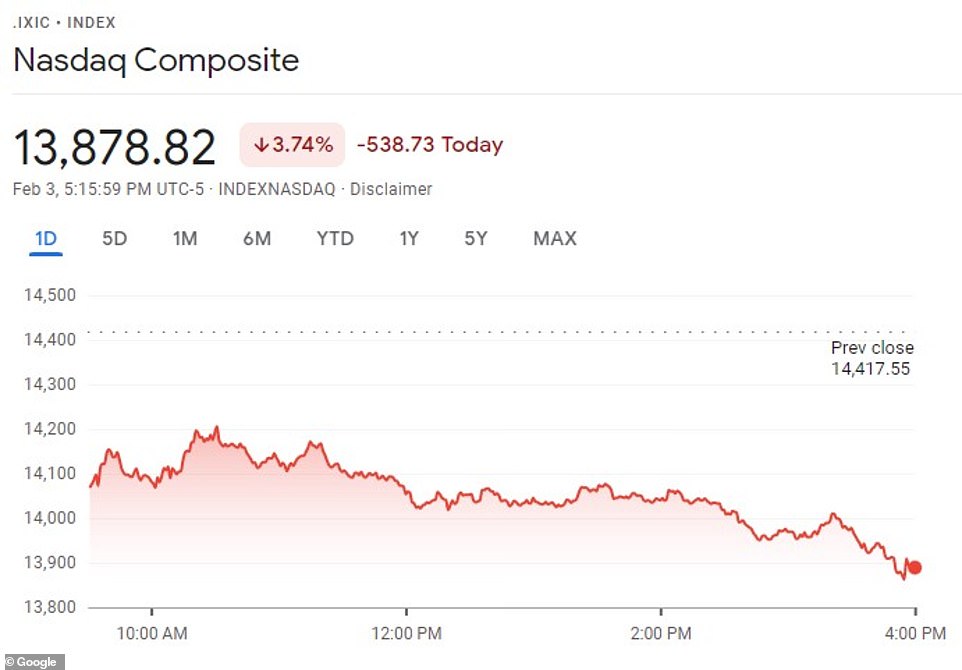

Facebook’s stock closed the day at $237.76 per share, sparking fear in international markets and pulling the tech-heavy Nasdaq down by 3.74 percent

Zuckerberg told his employees that the drop was due to a weak revenue forecast as the company faces an ‘unprecedented level of competition’ from TikTok, owned by Chinese company ByteDance.

The 37-year-old billionaire wore glasses and looked red-eyed, a person who attended the meeting told AdAge. Zuckerberg allegedly told his employees that he might tear up because he scratched his eye, and not because of the share drop.

The decline marked Facebook’s worst one-day loss since its Wall Street debut in 2012, and dragged down broader markets in the US and around the world.

After the markets closed, the Dow was down 518 points, or 1.45 percent. The S&P 500 dropped 2.44 percent and the Nasdaq was down 3.74 percent. Facebook is a component of the Nasdaq and S&P.

At the virtual meeting on Thursday, Zuckerberg responded to a question about burnout by saying that the company is considering offering long weekends, but he added that a four-day workweek would not be productive, according to a someone who was not authorized to speak about the meeting.

He encouraged employees to use their vacation days.

Another person familiar with the company’s plans told AdAge that employee shares vest on February 15, meaning that employees are able to earn shares of the company if they stay through that date. Also, conversations about raises and bonuses happen in March, potentially factoring into workers’ decisions to leave.

Facebook’s woes spilled over to Europe, where technology stocks posted some of the steepest declines and soured the mood across global financial markets in another busy day of central bank meetings.

Big U.S. tech companies have come under mounting pressure in 2022 as investors expect policy tightening at the U.S. Federal Reserve to erode the industry’s rich valuations following years of ultra-low interest rates.

The tech-dominated Nasdaq fell more than 8 percent in January, its worst monthly drop since the end of 2019.

‘The downgrade in the earnings outlook by Meta and other companies took markets by surprise,’ said Kenneth Broux, a strategist at Societe Generale in London.

‘The tech selloff spilled over to broader equity markets this morning and with the Fed preparing to raise interest rates, we could see more volatility going forward,’ he said.

Meta reported a decline in daily active users from the previous quarter for the first time as competition with rivals like TikTok, the video sharing platform owned by China’s ByteDance, heats up.

Meta said about 3 percent of worldwide monthly active users in the fourth quarter consisted solely of violating accounts while duplicate accounts may have represented about 11 percent of usage.

The disappointment over Meta’s earnings and the subsequent stock fall raised memories of the bursting tech bubble in 2000. Investors seem to be becoming highly selective after the sector’s record-breaking run in recent months. According to research firm Vanda, purchases from retail investors in late 2020 and early 2021 were focused on expensive tech, EVs and so-called ‘meme’ stocks. In the past week purchases of large-cap tech have skyrocketed while speculative assets have seen very little demand.

The so-called FAANG group of Facebook, Amazon, Apple , Netflix and Google’s Alphabet has seen around $400 billion in market capitalization wiped off in the opening weeks of 2022 as cheaper segments of the markets become more attractive while central banks taper stimulus. Other social media stocks were also hit hard in pre-market trading on Thursday, including Twitter, Pinterest and Spotify. Spotify has been beset by a row over COVID vaccination misinformation and also released disappointing results. Newly renamed Meta is investing heavily in its futuristic ‘metaverse’ project, but for now, relies on advertising revenue for nearly all its income. The metaverse is sort of the internet brought to life, or at least rendered in 3D. Meta CEO Mark Zuckerberg has described it as a ‘virtual environment’ in which you can immerse yourself instead of just staring at a screen. Theoretically, the metaverse would be a place where people can meet, work and play using virtual reality headsets, augmented reality glasses, smartphone apps or other devices. But building it is not likely to be cheap. Meta invested more than $10 billion in its Reality Labs segment – which includes its virtual reality headsets and augmented reality technology – in 2021, contributing to the quarter’s profit decline. It expanded its workforce by 23 percent, ending the year with 71,970 employees, mostly in technical roles.

The company also said revenue in the current quarter is likely to come in below market expectations, due in part to growing competition from TikTok and other rival platforms vying for people´s attention. Sheryl Sandberg, Meta’s chief operating officer, said in a conference call with analysts that global supply chain issues, labor shortages and earlier-than-usual holiday spending by advertisers put pressure on the company’s advertising sales.

Another problem: Recent privacy changes by Apple make it harder for companies like Meta to track people for advertising purposes, which also puts pressure on the company’s revenue. For months now, Meta has been warning investors that its revenue can’t continue to grow at the breakneck pace they are accustomed to.

‘It is time for a reality check on Meta´s position for the metaverse,’ said Raj Shah, an analyst at the digital consulting firm Publicis Sapient. ‘The metaverse is a long way from being profitable or filling the gap in ad revenue after Apple´s policy change.’ People’s changing online behavior is also limiting Meta’s money-making abilities. More people are watching video, such as Instagram’s Reels (a TikTok clone), and this makes less money than more established features.

The Menlo Park, California, based company said it earned $10.29 billion, or $3.67 per share, in the final three months of 2021. That’s down 8% from $11.22 billion, or $3.88 per share, in the same period a year earlier. Revenue rose to 20% to $33.67 billion. Analysts, on average, were expecting earnings of $3.85 per share on revenue of $33.36 billion, according to a poll by FactSet.

Meta Platforms Inc. took on its new name last fall to emphasize Zuckerberg’s new focus on the metaverse. Since then, the company has been shifting resources and hiring engineers – including from competitors like Apple and Google – who can help realize his vision. Zuckerberg is betting that the metaverse will be the next generation of the internet because he thinks it´s going to be a big part of the digital economy. He expects people to start seeing Meta as a ‘metaverse company’ in the coming years, rather than a social media company.

For now, though, the metaverse exists only as an amorphous idea envisioned – and named – by the science fiction author Neal Stephenson three decades ago. It’s not yet clear if it’ll be the next iteration of human-computer interaction the way Zuckerberg sees it, or just another playground for techies and gamers. This could be spooking investors, who tend to prefer immediate, or at least quick, results on investments. ‘There´s a lot of uncertainty about Meta´s investments in the metaverse and if or when they will have a positive impact on the company´s bottom line,’ said Debra Aho Williamson, an analyst with Insider Intelligence. ‘While we expect Meta to ramp up testing ads and commerce within its metaverse offerings this year, those efforts will be highly experimental and not likely to drive much revenue in the near term,’ she added.

Meta said it expects revenue between $27 billion and $29 billion for the current quarter, below the $30.2 billion analysts are forecasting. Meta has faced intense scrutiny over its effect on young people since former employee Frances Haugen leaked a series of internal documents to the Wall Street Journal, which published them in a series called The Facebook Files last year.

One message posted on an internal message board in March 2020 said the app revealed that 32 percent of girls said Instagram made them feel worse about their bodies if they were already having insecurities. Another slide, from a 2019 presentation, said: ‘We make body image issues worse for one in three teen girls. ‘Teens blame Instagram for increases in the rate of anxiety and depression. This reaction was unprompted and consistent across all groups.’ Another presentation found that among teens who felt suicidal, 13 percent of British users and 6 percent of American users traced their suicidal feelings to Instagram. The research not only reaffirms what has been publicly acknowledged for years – that Instagram can harm a person’s body image, especially if that person is young – but it confirms that Facebook management knew as much and was actively researching it. Zuckerberg spearheaded a sharp-elbowed response to Haugen’s allegations, refusing to apologize publicly and instead changing the company’s name to Meta to highlight his focus on building a virtual reality Metaverse.

Source: Dailymail.co.uk