The Commercial Bank of Ceylon has been reaffirmed the Best Bank among Sri Lanka’s domestic banks by FinanceAsia, one of the world’s foremost information sources on the Asian financial markets.

Notably, this is the 13th year that Commercial Bank has been bestowed this prestigious title by FinanceAsia.

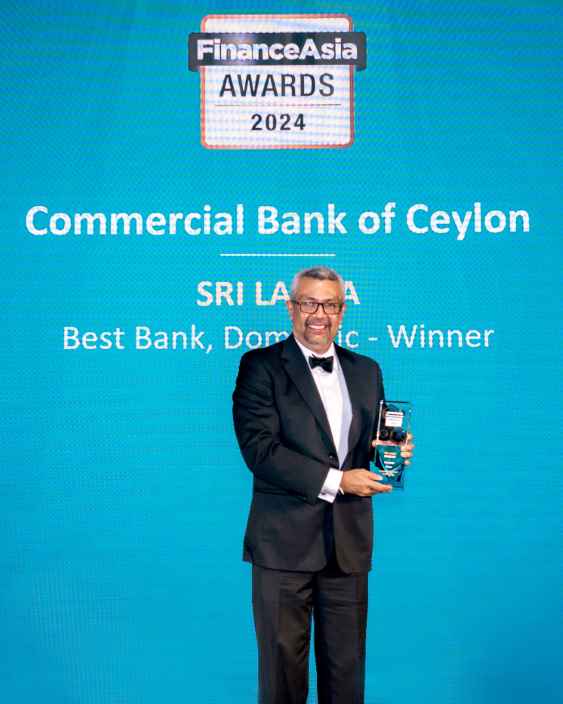

The Best Bank award was presented to Commercial Bank at the FinanceAsia Country Awards gala at the Ritz Carlton in Hong Kong on 27th June. The Bank’s Chief Risk Officer Mr Kapila Hettihamu accepted the award on behalf of the Bank.

Commenting on this latest international honour conferred on the Bank, Commercial Bank Managing Director/CEO Mr Sanath Manatunge said: “This recognition underscores the Bank’s strategic agility and excellence in delivering outstanding performance across multiple areas of assessment, despite fluctuating external environmental factors. It also reflects our consistent ability to thrive in both favorable and adverse conditions, highlighting our strategic foresight and operational integrity. This accolade is a testament to our long-term vision, steadfast dedication, and the trust our stakeholders place in us.”

Other Country Award winners ranked alongside Commercial Bank as the Best Domestic Banks in their respective countries at this year’s FinanceAsia awards were Bank of China (Hong Kong), CTBC (Taiwan), Bank Mandiri (Indonesia), Public Bank (Malaysia), Techcombank (Vietnam), Allied Bank (Pakistan), and City Bank (Bangladesh).

Announcing this year’s winners, FinanceAsia said: “While we still see choppy financial markets amid high interest rates, it is worth pausing to recognise leading financial institutions across Asia that have performed well and made waves in these volatile times. The goal posts have not changed: each of Asia’s markets is bound by net zero commitments; and digital transformation continues to drive regulatory discourse and development around emerging sectors and virtual assets. As a result, sustainability and digitisation continue to be underlying themes shaping a new paradigm for deal-making in the region.”

Assessments for the FinanceAsia Best Domestic Bank awards covered the performances of banks in 2023. “Our awards process celebrates those institutions that showed determination to deliver desirable outcomes, through display of commercial and technical acumen,” FinanceAsia said.

The largest private sector bank in Sri Lanka with Group assets of Rs 2.656 trillion, deposits of Rs 2.148 trillion, a loan book of Rs 1.296 trillion and gross income of Rs 341.566 billion as at 31st December 2023, Commercial Bank was also the biggest lender overall, to the country’s Small & Medium Enterprise (SME) sector in 2023. The Bank continued to be the benchmark private bank in Sri Lanka with the highest market shares among private sector banks in deposits, loans, total assets, market capitalisation, gross income and total capital base.

First published in 1996, FinanceAsia provides readers with the latest financial trends, interviews, features and investigative reports. The company is owned by Haymarket Media Limited, the largest privately-owned publishing group in the UK.

Sri Lanka’s first 100% carbon neutral bank, Commercial Bank is the first Sri Lankan bank to be listed among the Top 1000 Banks of the World. The Bank is the largest lender to Sri Lanka’s SME sector, and is a leader in digital innovation in the country’s Banking sector. Commercial Bank has the widest international footprint among Sri Lankan Banks, with 20 outlets in Bangladesh, a Microfinance company in Nay Pyi Taw, Myanmar, and a fully-fledged Tier I Bank with a majority stake in the Maldives.