-Stocks surge in signal of strengthening investor confidence-

18th January 2025: Adani Group companies witnessed a significant surge in their stock prices, rising up to 7 percent in early trading on January 16, 2025, following the announcement that Hindenburg Research, the controversial US-based short-selling firm, would cease operations. The news is a notable turning point for the conglomerate, which had faced substantial market turbulence following Hindenburg’s targeted report in early 2023.

Nate Anderson, founder of Hindenburg Research, announced the firm’s closure on their website, stating, “I have made the decision to disband Hindenburg Research. The plan has been to wind up after we finished the pipeline of ideas we were working on.”

Under short selling, the investor expects the stock price to fall over time and hence builds a ‘short position’ by borrowing the stock at current levels and squaring off when its price goes low, pocketing the difference.

Anderson’s announcement comes as the firm completes its tenure in the financial markets, during which it gained particular prominence for it’s reports on companies like EV manufacturer Nikola Corp, Block Inc. (promoted by Twitter founder Jack Dorsey), and Icahn Enterprises, besides the Adani Group.

The market response was immediate and positive across all Adani Group stocks. Adani Green Energy led the rally with a nearly 6 percent increase, while other group companies including Adani Ports and Adani Power gained over 4 percent each. Adani Enterprises, Adani Energy Solutions, ACC, Ambuja Cements, and NDTV also saw gains between 3-4 percent.

The development represents a significant shift from January 2023, when the Hindenburg’s report, accused the conglomerate of ‘pulling the largest con in corporate history’ and alleged stock manipulation. The report triggered a massive selloff in Adani Group stocks. The Adani Group had denied all allegations, and the group subsequently recovered most of its market losses as the allegations failed to find substantial ground.

Adani Group CFO, Jugeshinder ‘Robbie’ Singh, responded to the news with a cryptic post on social media platform X, suggesting a vindication of the group’s position throughout the controversy.

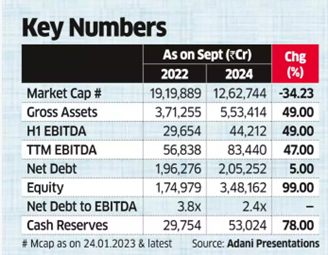

While many of Hindenburg’s target companies have either closed down or faced significant regulatory penalties, Adani Group was vindicated by Indian regulators and courts and emerged stronger financially as can be seen from the table below.